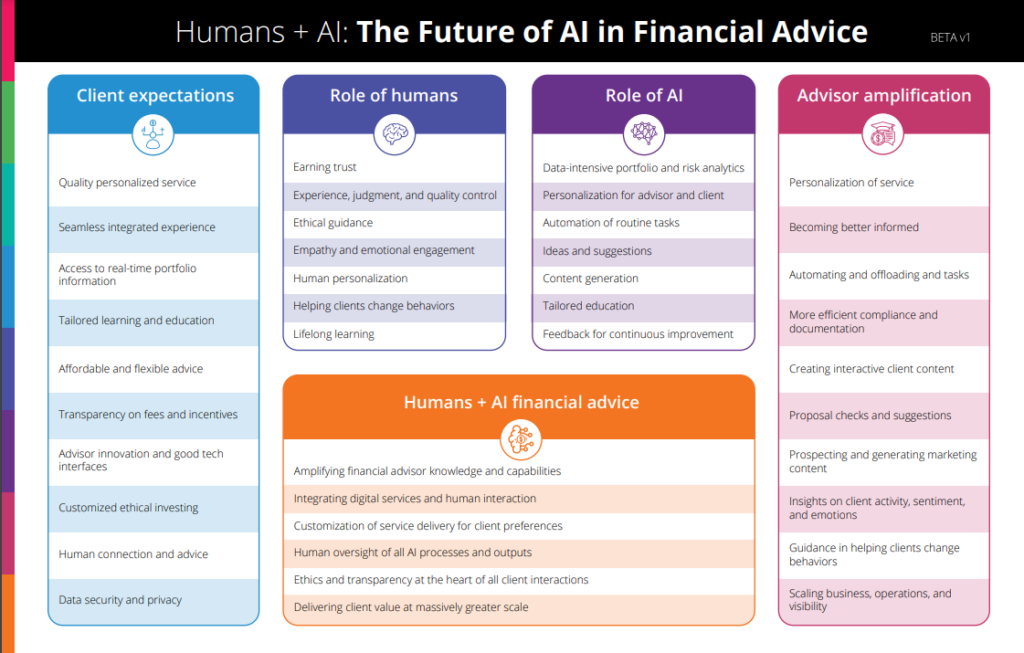

A map of The Future of AI in Financial Advice.

Click on the image for the full size pdf.

See more detailed insights on the future of financial advice

Client Expectations

- Quality personalised service

- Seamless integrated experience

- Access to real-time portfolio information

- Tailored learning and education

- Affordable and flexible advice

- Transparency on fees and incentives

- Advisor innovation and good tech interfaces

- Customized ethical investing

- Human connection and advice

- Data security and privacy

Role of Humans

- Earning trust

- Experience, judgment, and quality control

- Ethical guidance

- Empathy and emotional engagement

- Human personalisation

- Helping clients change behaviours

- Lifelong learning

Role of AI

- Data-intensive portfolio and risk analytics

- Personalisation for advisor and client

- Automation of routine tasks

- Ideas and suggestions

- Content generation

- Tailored education

- Feedback for continuous improvement

Advisor Amplification

- Personalisation of service

- Becoming better informed

- Automating and offloading tasks

- More efficient compliance and documentation

- Creating interactive client content

- Proposal checks and suggestions

- Prospecting and generating marketing content

- Insights on client activity, sentiment, and emotions

- Guidance in helping clients change behaviours

- Scaling business, operations, and visibility

Humans + AI Financial Advice

- Amplifying financial advisor knowledge and capabilities

- Integrating digital services and human interaction

- Customisation of service delivery for client preferences

- Human oversight of all AI processes and outputs

- Ethics and transparency at the heart of all client interactions

- Delivering client value at a massively greater scale